Ensure Compliance with UAE’s Corporate Tax Law

Prepare your business for the UAE’s Corporate Tax Law, effective June 2023, with My Startup Dubai’s expert guidance. Download our free Corporate Tax Guide to understand essential steps and stay compliant.

About UAE Corporate Tax

The UAE introduced a Corporate Tax Law effective June 2023, impacting businesses with specific income thresholds. My Startup Dubai offers expert support to ensure your business complies seamlessly. Download our free Corporate Tax Guide for key steps and answers to common questions.

Take Advantage of Our Limited-Time Offer

Download our free UAE Corporate Tax Guide to discover the 3 key steps to becoming tax-ready and get answers to the most commonly asked questions about the new Corporate Tax Law.

Key Information on UAE Corporate Tax

Documents Required:

Businesses with an annual income exceeding AED 375,000 are subject to corporate tax. Explore details in the “Who Will Be Subject to Corporate Tax in UAE?” section of our free PDF.

Application Process:

Free zone businesses in specific zones are exempt from corporate tax until at least 2069. Check the “Corporate Tax for Free Zone Businesses” section in our free PDF.

Why Choose My Startup Dubai for Corporate Tax Services

Our expert team ensures quick, compliant, and tailored Service for you

Expert Guidance

In-depth knowledge of UAE’s Corporate Tax Law for accurate compliance.

Comprehensive Support

We guide you through tax preparation and filing requirements.

Free Resources

Access our detailed Corporate Tax Guide at no cost.

Tailored Solution

Customized advice for mainland, free zone, and offshore businesses.

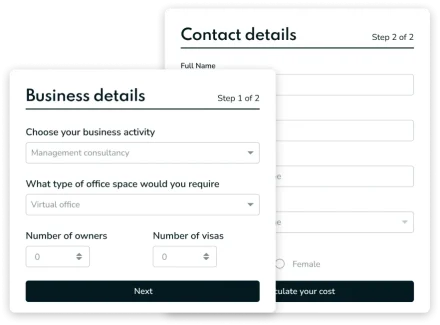

Calculate your business setup cost

Get an estimate for your company setup in your preferred currency in under a minute with our cost calculator.

Would you like to start a project with us?

Have questions or need more information? Request a callback from our consultants.