Free Zone Company Setup in Dubai

A free zone company in the UAE is registered in specialized economic zones like Dubai International Financial Centre (DIFC), Dubai Multi Commodities Centre (DMCC), or Ras Al Khaimah Economic Zone (RAKEZ). These companies benefit from tax exemptions, 100% foreign ownership, and no customs duties, making them ideal for global businesses. My Startup Dubai provides expert guidance to ensure a seamless and compliant free zone company setup tailored to your goals.

The UAE hosts over 50 free zones, with some offering versatile activities for all industries and others tailored to specific sectors. My Startup Dubai guides you to the ideal free zone for your business, ensuring a seamless setup.

Advantages:

- 100% Ownership

- No NOC (No Objection Certificate) Required from Current Employer

- No Paid-Up Share Capital Required

- Option to Incorporate a Company Under Common Law

- Physical Office Space Not Mandatory

- 0% Corporate and Income Tax

- Option to Incorporate Remotely

- Flexibility to Incorporate in Jurisdictions Where Employee Health Insurance is Not Mandatory

Popular Licenses

Crypto Trading License

Ready to dive into cryptocurrency trading in Dubai? My Startup Dubai provides comprehensive support for setting up your crypto business.

General Trading License

Engage in a wide range of commercial activities, including import, export, and distribution, with a General Trading License.

E-Commerce Trade License

Legitimize your online business with a UAE e-commerce license, ensuring compliance with local regulations.

Management Consultancy License

Offer professional advisory services across various sectors with a Management Consultancy License.

Real Estate License

Capitalize on the UAE’s booming real estate market by owning and managing properties.

Digital Marketing License

Start a digital marketing business covering online advertising, SEO, and social media management.

UAE Free Zones

The UAE comprises seven emirates—Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman, Umm Al Quwain, and Ras Al Khaimah—each offering unique free zones. Explore the advantages and locations with My Startup Dubai to choose the best free zone for your business needs:

Abu Dhabi

- Abu Dhabi Global Market (ADGM)

- Abu Dhabi Airport Free Zone (ADAFZ)

Dubai

- International Free Zone Authority (IFZA)

- Dubai Multi Commodities Center (DMCC)

- Dubai Airport Free Zone(DAFZA)

- Jebel Ali Free Zone (JAFZA)

- Dubai Silicon Oasis Authority (DSOA)

- Dubai International Financial Centre (DIFC)

- Meydan Free Zone (MFZ)

Fujairah

- Fujairah Free Zone Authority (FFZA)

Ras Al Khaimah

- Ras Al Khaimah Economic Zone (RAKEZ)

- RAK International Corporate Centre (RAK ICC)

Sharjah

- Sharjah Publishing City (SPC)

- Sharjah Media City (SHAMS)

- Sharjah Research Technology and Innovation Park (SRTIP)

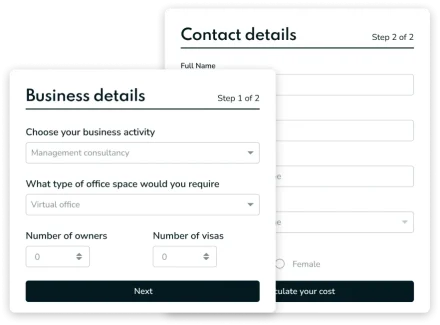

Calculate your business setup cost

Get an estimate for your Freezone company setup in your preferred currency in under a minute with our cost calculator.

License Types and Activities

UAE free zones offer over 3,000 business activities, catering to diverse industries. Contact My Startup Dubai’s consultants for detailed guidance on selecting the right activities for your business.

For more details on business activities, contact My Startup Dubai.

Commercial License

A Commercial License is required for businesses in the UAE engaged in trading and supplying goods, including:

Mobile phones & accessories trading

Building material, cleaning, and safety equipment trading

Oil & gas, chemicals trading

Automobiles, spare parts trading

Gold & precious metals trading

Industrial License

An Industrial License is required for manufacturing or industrial activities in the UAE, such as:

Garments, uniforms manufacturing

Meat, dairy products manufacturing

Animal & birds feed manufacturing, fishing net making

Pastry & sweets manufacturing, mineral water bottling

Fabrics & textiles embroidery, carpets manufacturing

Professional License

A Professional License is required for individuals or groups offering expertise-based services in the UAE, including:

Electronic, Mechanical Engineering Consultancies

Science & Technology Consultancy

Immigration, Educational Consultancies

Health Awareness, Project Management Consultancies

Marketing Research, Media Consultancies, Corporate Services Provider

Our Process for Freezone Company Setup

1

Choose Business Activity

2

Finalize company name

3

Complete incorporation paperwork

4

License issuance

5

Open company bank account

6

Receive immigration card

7

Process residence visa

Requirements for Setting Up a Free Zone Company

Shareholders

Minimum of one shareholder; corporate shareholders are permitted, with attested documents required for international corporate shareholders.

License Type

Select commercial, professional, or industrial licenses.

Business Activity

Select from over 30 activities, such as trading, consultancy, or e-commerce.

Documentation

Provide passports, business plans, and other required documents.

Office Space

Choose flexi-desks, offices, or warehouses based on free zone offerings.

Our Process for Offshore Company Setup

1

Choose Business Activity

2

Finalize Company Name

3

Complete Incorporation

Paperwork

4

License Issuance

5

Open Company Bank Account

Would you like to start a project with us?

Have questions or need more information? Request a callback from our consultants.